Thanks for your support! If you make a purchase using our links in this article, we may make a commission. And, as an Amazon Associate, I earn from qualifying purchases. See the full disclosure here.

RV renter insurance is a fact of life. If you want to rent out your motorhome or travel trailer, you’ll need RV rental insurance for RV owners. Think about it like this—no one loans out their equipment without certain assurances.

That assurance may be nothing more than friendship or comfort in the knowledge that the person will return the item just as they took it. RV rental insurance for RV owners gives you that peace of mind and protection if something happens while your rig is rented out. After all, your RV is relatively expensive, and most standard RV insurance policies don’t have rental coverage.

When you rent out your RV, someone you don’t know will completely control your baby. Knowledge, however, is power. Peer-to-peer RV rental companies allow you to get to know who’s renting your rig before you hand them the keys, but there’s always that unforeseen chance something could happen.

Whether you’re new to RV renting or have been doing it for a while, come with us as we explore why you need RV rental insurance for RV owners.

Do You Need Rental Insurance to Rent Out Your RV to People?

First of all, you need RV rental insurance for RV owners to rent out your RV to people because it will be out of your hands for a specific period. Second, regular RV insurance policies usually don’t cover the RV or the occupants when it’s rented out. The only solution is RV renter insurance.

For the most part, you’ll recoup your premium by including it in the cost of the rental. RV renter insurance starts the moment the RV is in the possession of the renter and ends when it’s returned.

Will Your Standard RV Insurance Cover You if You Rent Out Your Rig?

In most cases, standard RV insurance coverage won’t cover you if you rent out your rig. Even if your regular RV insurance covers some things, it won’t be anywhere near what’s necessary. Fortunately, renter insurance isn’t overly complex, and it’s not so expensive to render rental profits extraneous.

Depending on what company you rent through, the rental insurance service is a part of the entire package, which makes things a lot easier for you.

What Kind of Insurance Do RV Owners Need to Rent Out Their RV?

Roamly is an excellent option if you want to keep things simple. They offer standard RV insurance policies like most other companies. However, they don’t prohibit coverage from rentals, depending on the package you choose.

Additionally, some RV rental agencies work with Roamly, so you can take advantage of discounts on your premiums when renting your RV out.

What Will Your Insurance Policy Cover When You Rent Out Your RV?

A solid insurance policy that covers renters will cover all the bases you’re used to with your own coverage. However, if you rent through another agency, such as Outdoorsy or RVshare, you only need insurance that allows you to rent and nothing more. Those agencies take care of the rest.

- Liability

- Collision

- Comprehensive

- Uninsured Motorist

- Underinsured Motorist

There is a minimum in every state, which applies to you and your renter. But you don’t want to stick with just the minimum because it’s a huge risk.

What Will it Not Cover?

RV rental insurance, in general, won’t cover daily upkeep and general maintenance issues. That’s why it’s important to keep up with oil changes, tire maintenance, and keep the interior of the RV in good working order.

If there is a minor gadget in the RV that doesn’t work at the time of the rental, make sure it’s notated on the rental agreement. The renter can’t be held responsible for something that they didn’t break.

Do People You Rent To Need Insurance?

Renters need their own RV rental policy to protect themselves, their property, and cover the costs of any repairs they’re responsible for in case of any damage during their rental.

They may not want it, but they need it. More importantly, you need it. After all, you get to foot the bill if something goes wrong. The good part is rental companies require RV renters to have this third-party liability insurance, as well as most states. There are a couple of ways this can go.

First, you purchase RV insurance through Roamly or another reputable RV insurance provider that allows you to rent. When renters are ready to go on an RV vacation, they must purchase their own RV rental coverage. The big peer-to-peer rental companies provide RV rental coverage for both renters and owners. These big peer-to-peer rental companies include:

What Will Their Insurance Policy Cover?

RV renter’s policies cover their personal property, medical issues, and damage that they’re involved with while in possession of the RV. Peer-to-peer RV rental companies typically offer insurance packages for renters to purchase, which all go into the same bill. If you rent on your own, the policy will cover renters to the extent of your RV’s value.

What Will it Not Cover?

RV renter’s third-party liability coverage won’t cover issues you, as the owner, are responsible for, which typically boils down to preventative concerns. Things you are responsible for. Wear and tear of the RV, regular maintenance, engine issues, and things of that nature.

4 Coverages You Need When You Rent Out Your RV

You will need the state minimum in terms of liability. But you’ll want much more. You could say that you need the list below because it will cost you an arm and a leg if you don’t. In some cases, not having certain coverage could open you up to civil liability.

1. Liability

This is the state minimum, and typical insurance policies cover your RV up to $1 million in the U.S. and up to $2 million if you happen to live in Canada. Liability will cover accidents caused by the renter, including the other party’s medical expenses.

2. Comprehensive

Comprehensive covers things like theft and fire while the RV is under the care of the renter. If a tree falls on the RV, comprehensive will cover the damage to the roof, sidewalls, frame, interior, and anything else directly damaged by the tree.

3. Collision

Collision covers your RV’s repair and replacement costs, whether the renter causes the damage or another party.

4. Uninsured and Underinsured Motorist

Some states (but not all) require variations of uninsured and underinsured motorists. This coverage fills in the gaps where the motorist in question lacks insurance or doesn’t have a sufficient policy to cover the full cost of the damage.

Best RV Insurance that Allows Renting

We’ve already mentioned Roamly several times, giving ourselves away for this question. However, the point still stands that Roamly is the best RV insurance provider that allows renting.

As we stated above, you have to have two insurance types to cover renters, and the first is where Roamly can protect you with RV rental insurance for RV owners. Most insurance companies would drop you from their policy if they found out you were renting.

Roamly won’t. Not only do they allow it, but they also simplify it. You can also bundle your home and auto insurance with your RV insurance, taking advantage of RV renter insurance on the days when the RV is rented.

Roamly Insurance Reviews

Roamly is a well-known insurance company amongst RVers and if you want a real gauge of how good Roamly is for insuring your RV, ask around the next time you make camp. Trustpilot has a compilation of 151 reviews with an overall rating of 4.7 out of 5.0.

Roamly maintains a 4.5 out of 5.0-star status on Consumer Advocate as well. For what it’s worth, Roamly works in conjunction with Outdoorsy, which maintains a 4.4 out of 5.0 status on Trustpilot with 23,388 reviews.

Roamly and Outdoorsy are behemoths within the RV industry, and they didn’t get there because they offer shoddy features and maintain poor customer service.

4 FAQs About RV Rental Insurance for RV Owners

1. Is renting out your RV financially smart?

It’s a business and a sound and smart financial strategy if you know how to run a business. That includes marketing, customer service, features you offer, and what you bring to the table for repeat renters. If you rent for 150 days per year, you have the potential to earn a few hundred to a few thousand dollars a year.

2. How Much Does RV Rental Insurance Cost When You Rent Out Your Rig?

The potential costs vary depending on what kind of RV you’re renting out. Class A motorhomes cost a lot more to insure than pop-ups. It costs anywhere between $600 and $1,400 per year. Roamly will net you some pretty steep discounts on those numbers as well.

3. Does Renting Out Your RV Require a Commercial Insurance Policy?

You’ll need an RV commercial insurance policy if you rent out more than one RV. You can own two RVs (use one personally and rent the other) and avoid paying for a commercial policy. The moment you rent out two, commercial policies come into play.

4. Why Do You Need Additional Insurance to Rent Out Your RV?

Most RV insurance policies won’t cover RVs when rented to a third-party. Before handing over the keys to your renter, verify that they have their own third-party RV renter’s policy by looking over the paperwork, even if it’s on their mobile device.

Is it Worth it to Rent Out Your RV?

Only you can decide if the risk of renting out your RV is worth it. It can be a lucrative side option, but at the end of the day, some anxiety may be involved while someone else is out and about in your RV. There is an increase in maintenance involved, more insurance, and a significant chunk of your attention.

Fortunately, there are plenty of benefits as well. You get to offset many of your RV costs, avoid sticking it in storage, and meet more RVers or, at least, introduce people to the RV life. Ultimately, it’s exactly what you make it.

Related Reading:

1. Drivable vs. Towable RV Rentals – Which is Best?

2. The Wrong RV Rental Insurance Leaves You Exposed

3. What Is The Best RV Rental Company?

4. How to Find Cheap RV Rentals Under $100 a Night

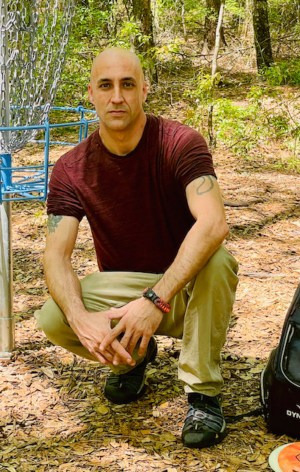

Thomas Godwin – Author and Part-Time RVer

Thomas Godwin is a full-time freelance writer with a BFA in Creative Writing, a U.S. Marine, and an avid outdoorsman.

Thomas’s love for RVing began at an early age spending time camping in the family vintage Airstream.

His background and education in writing, combined with his passion for the outdoors, can be seen in publications such as Camper Smarts and Vanlifers, as well as multiple animal and outdoor recreational publications.

When he’s not writing, he’s raising chickens and Appleyard ducks. Thomas also constructs teardrop campers (attempting to anyway) and kayaks the Blackwater River with his wife, two daughters, and his Dobermans.