Thanks for your support! If you make a purchase using our links in this article, we may make a commission. And, as an Amazon Associate, I earn from qualifying purchases. See the full disclosure here.

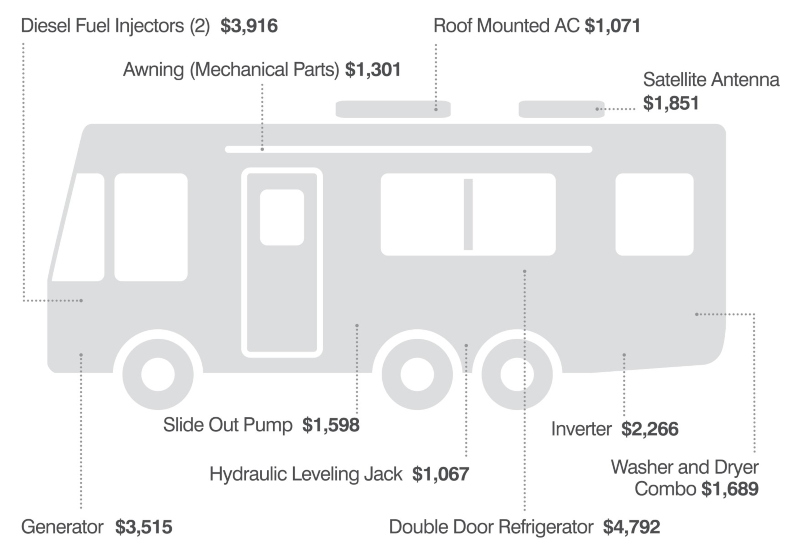

What makes RV insurance expensive is an top-end RV. Sure, that’s a laughable oversimplification, but in broad terms, it’s very true. If a Winnebago Micro Minnie FLX only carried a value of $500 brand new (don’t we all wish?), insurance premiums would be microscopic.

Of course, there is way more that goes into the cost of RV insurance than value, although that’s the driving factor. Other factors, such as size, the minimum coverage of your state, the type of RV, your choice in coverage, and your insurance provider, are all major players.

Even the individual components that make up the overall specs of an RV influence your insurance costs. Then there are the tiny factors that make RV insurance expensive. Lets dive in a little deeper as to why RV insurance can be so costly.

Is Insurance on an RV Expensive?

Yes, insurance on an RV can get pretty expensive. Not to the point where it’s unaffordable. If that were true, you wouldn’t see many RVs on the road. And, of course, expensive is relative. What is expensive to someone could seem affordable to another, depending on income, monthly bills, and other factors.

How Much Does RV Insurance Cost on Average?

Unfortunately, there is no constructive way to come up with an average cost of RV insurance because of all the unknowns. For instance, a Class C motorhome insurance rate ranges between $500 to $3,000. That’s a huge gap.

Throw in Class A motorhomes, Class B, and travel trailers (everything from a teardrop to a fifth wheel), and the calculations are extensive. It’s much easier to come up with a number per state than across the country, and there’s also a huge disparity there.

You’re more likely to have a higher RV insurance range per year in Michigan while paying less in states like Oregon or North Carolina.

Why is RV Insurance so Expensive?

Consider the state’s minimum requirements for RV insurance. Every one of them requires bodily injury liability.

Most states want property damage liability insurance as well. Once the mandates are out of the way, there remain several driving factors.

- The size of the RV

- Choice of full-time, part-time, and vacation liability

- Personal effects coverage

- Every provider will offer different rates

- The age of your RV and its condition

- Your personal driving record

- Additional coverage add-ons

- How many claims you’ve filed in the past

Throw in emergency coverage and roadside assistance, and the costs increase even more. You can get away with the bare minimum of state requirements, but it will also leave you woefully unprotected in certain events.

Is RV Insurance More Expensive Than Car Insurance?

On average, RV insurance tends to be less expensive than car insurance. Keep in mind the term “RV” is all-encompassing here. Plus, there is less risk associated with RVs than cars (at least in general terms) for several reasons.

- RV owners are generally older and more experienced on the road

- There are far fewer RVs on the road than cars

- Even young RVers tend to be married and family-oriented

- Statistically, RVers are safer drivers and have fewer claims

Obviously, a Class A motorhome will have a higher insurance premium than the average passenger vehicle unless that vehicle happens to be a Lamborghini Aventador or something along those lines.

What Does RV Insurance Typically Cover?

As we mentioned above, all states mandate bodily injury liability, and most states mandate property damage liability as well. For full-time RVers, personal liability, medical payments, and loss coverage is the norm. Those cover body and property damage, along with medical payments for others.

Liability is minimal, much like car insurance, and everything else is an add-on feature.

- Property damage (opt for higher or lower coverage)

- Accidental death

- Underinsured and/or uninsured driver

- Collision

- Vacation liability (an interesting option that covers people in your “RV space”)

- Personal Property (fires, theft, tip-over)

- Emergency (for when you have any type of covered emergency while traveling)

- Comprehensive (damage caused by anything other than a collision)

- Bodily injury (opt for higher or lower coverage)

Is an RV Covered Under Auto Insurance?

As far as your auto insurance policy, some states will allow a towed trailer or hauled truck camper coverage on your auto policy. Make sure you read the details, so you know exactly how these RVs are covered. Usually, small towed trailers are treated like utility trailers, and truck campers are treated similarly to general hauled cargo.

Motorhomes have to be insured as drivable RVs. Since they meet the minimum requirements as RVs, and you’ll want to recover as much as possible from any damage, you will need to insure them correctly.

9 Factors That Impact the Cost of RV Insurance?

While we glossed over the contributing factors above, here is a more detailed breakdown of factors that impact insurance costs.

1. Domicile State Laws

If you plan on living in your RV full-time, the insurance company uses your domicile zip code your RV is registered to determine its rate. The laws on domicile and residency are mostly based on case law from state to state. Using an RV mail service and registering your RV within that state and county generally help you avoid any legal headaches.

2. Type of RV

Larger, luxurious motorhomes will command a higher premium than smaller Class C or Class B motorhomes. Towables can be even cheaper per month. That’s just the nature of the beast.

3. How You Use Your RV

When you are in the process of purchasing insurance, the agent will ask you how often you plan on being on the road. More often equals a higher expense. What you choose to add to the bottom-line liability is often determined by how much you’ll be on the road as well.

In other words, full-timers will have the highest costs while summer weekenders pay the least amount.

4. Age and Condition of RV

The older the RV, the lower the overall value. Throw in things like slide-outs and mechanized features, and the value is a bit higher, but insurance companies will only insure the motorhome or travel trailer based on its actual value.

The love, care, and expense you may have put into your RV may have been a true investment, but at the end of the day, it’s still a 20-year-old RV (or whatever age).

5. RV Insurance Provider Policies

This can get complicated, but you shouldn’t let it. Every provider is different, and you should make an entire day out of policy shopping. Then there are the bundling options, paperless billing, pay-in-full, veteran, good driver, and homeowner benefits that each provider treats differently.

6. Coverage Options

The key word here is “options.” These obviously affect your overall cost as you add them on. Fewer options equal less coverage and less expense. It’s a fine line to walk, depending on what you want and can afford.

7. Bundles or Extras

Bundles save money. For instance, bundling your RV, home, and auto insurance into a single premium often saves a lot of money. It’s an effective way to drive down costs with a single insurer.

8. Driving Record and Experience

Statistics, statistics, statistics. Your stats go into the calculation pool along with all of the compiled statistics on the highway—everything from collision statistics in specific motorhomes to birds crashing into windshields. If there’s a stat for it, insurance companies have it and love it.

9. Claims History

There’s no escaping this one. If you can fix it yourself, you should, unless it’s catastrophic. The more claims you file, your insurance premiums will go up.

What is the Best Insurance Provider?

The little insurance company that could, Roamly, has grown into a powerhouse insurance provider for RVs. From its humble beginnings in Texas to well over 3,000 agents, Roamly is now a parent company as well and is considered one of the best RV insurance providers on the market.

One of the biggest reasons they are so successful is their straightforwardness. Insurance is a complicated network of even more complicated networks, and Roamly tries to keep things fairly simple. This is what you want.

They also cover everything you can expect from an RV insurance provider, including all classes of RV and RV rental insurance.

FAQs About RV Insurance Expenses

1. How does RV Insurance differ from car insurance?

When it comes to motorhomes, not much, except for size and property within. With travel trailers, auto insurance considers a trailer as a towable that holds things inside of it. However, RV insurance is a specialized coverage that covers everything from the tongue to the rear bumper.

2. How much RV insurance do I need?

That’s entirely up to you. In truth, you only “need” what the state you reside in mandates. Everything after that is associated with your wants and preferences. But remember, the RV insurance company will only pay what the RV is valued at the time of the claim.

3. How much is RV insurance per year?

Depending on what you have, RV insurance runs between $300 to over $4,000 annually, with an average between $500 and $900.

4. How much does RV insurance cost per month?

Generally, expect to pay between $40 and $1,000 per month on RV insurance. Again, much of this is entirely based on your personal preferences. The state-mandated minimums are not shockingly expensive on their own.

5. How much is insurance for an RV trailer?

Most people insure their travel trailers, but no one will twist your arm about it. If you’re paying it off, you will likely have to have specific coverages, depending on the finance contract.

6. How much is RV insurance for full-time living?

Full-time RVers typically pay between $2,000 and $4,000 annually. That’s because they have different needs than part-timers or weekenders.

Final Thoughts on Why RV Insurance is Expensive

RV insurance can be expensive, but it’s not the worst. In many cases, it’s less expensive than your car insurance. If you have had a handful of speeding tickets in the last two years, that statement might not be of any consolation. But you get the point.

It’s also expensive because it’s a necessity. You have to have the minimum liability coverage mandated by state law. Everything else is entirely up to you. It makes sense to add various coverage options, and a lot of it is guesswork. You don’t know that your motorhome will sling a rod, but it might.

Outside of the bottom line, RV insurance is as essential and expensive as you make it. Depending on the state you’re in and what coverage options you want to apply to protect what’s yours.

Related Reading:

1. How Much Does RV Insurance Cost?

2. Is RV Travel Insurance Worth the Money?

3. The Wrong RV Rental Insurance Leaves You Exposed

4. Does Insurance Cover RV Windshield Replacement?

Thomas Godwin – Author and Part-Time RVer

Thomas Godwin is a full-time freelance writer with a BFA in Creative Writing, a U.S. Marine, and an avid outdoorsman.

Thomas’s love for RVing began at an early age spending time camping in the family vintage Airstream.

His background and education in writing, combined with his passion for the outdoors, can be seen in publications such as Camper Smarts and Vanlifers, as well as multiple animal and outdoor recreational publications.

When he’s not writing, he’s raising chickens and Appleyard ducks. Thomas also constructs teardrop campers (attempting to anyway) and kayaks the Blackwater River with his wife, two daughters, and his Dobermans.