Thanks for your support! If you make a purchase using our links in this article, we may make a commission. And, as an Amazon Associate, I earn from qualifying purchases. See the full disclosure here.

There are so many factors that come into play when you are trying to find recreational vehicle (RV) insurance. One of the things I learned on our journey toward becoming insured is that if you are buying a brand new RV it is essential to make sure that you are covered 100% in case anything ever happens. We learned this from our RV dealer where we bought our travel trailer. What he meant was, he wanted us to make sure that we had a “replacement cost” policy. RV insurance can cover the actual cash value (depreciated value) or the total replacement cost if your RV is totaled or stolen.

Replacement cost is great to have, especially if your RV is a total loss. Companies tend to limit total replacement cost coverage to newer RVs. Say, if you are driving down the highway, and a massive gust of wind picks up, and you tip over, and now your trailer is damaged beyond repair. Replacement cost insurance will pay for you to get a brand new trailer and not just pay the remaining balance on your current trailer.

It is essential to make sure that you call around and get several quotes for your RV insurance. Many people just go with their current auto coverage insurance company because it’s convenient. Or they go with the insurance company that the dealer suggests. Our dealer suggested a company, so of course, we called them. The price seemed reasonable, and we were getting ready to go through with it, and then we decided to make a few more phone calls. As it turns out, by going with our auto policy insurer, we are only paying $339 for the year for our travel trailer!

How Much Does RV Insurance Cost?

First, you want to be sure that your insurance is compliant with your home state’s RV insurance laws. Your RV insurance rates will vary depending on the model, type, and age of your RV. If you have a decent driving record, your rates will be lower just like car insurance.

Your credit score is considered as well. They want to make sure that you have a good payment history so the insurance company can make sure they are going to be getting paid on time.

Are you going to be storing the RV in a lot, in your yard, or on the street while not in use? If you are going to be living in your RV permanently, your rates will be a little higher as well.

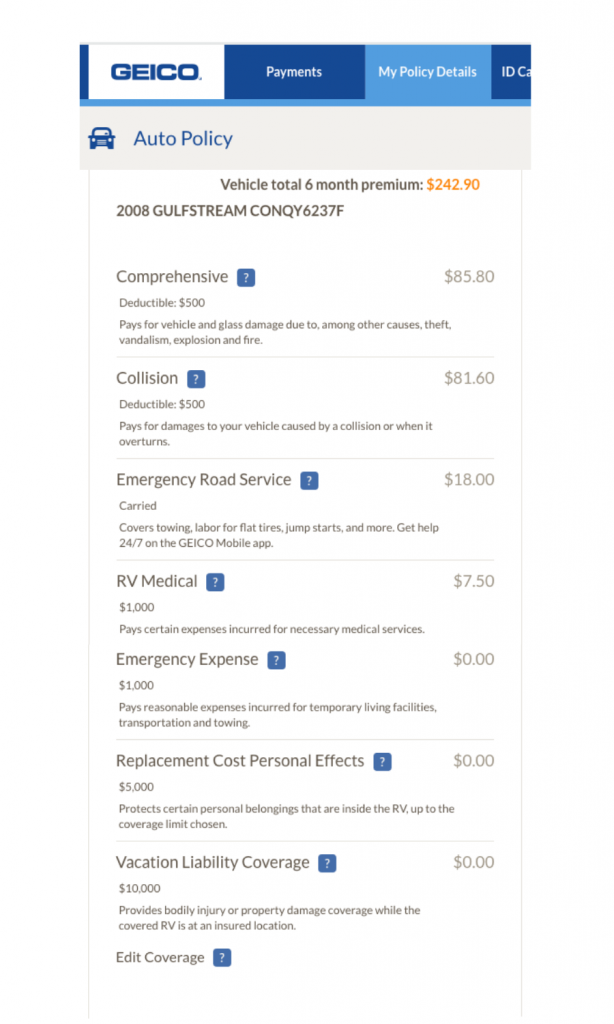

Here is a screenshot of Mike’s 6-month insurance premium cost for his Class C motorhome.

The only real way to figure out what your rate will be is to call around or get quotes from the internet. I prefer to call. That way if a question arises while I am getting the quote, the agent on the other end of the line would be able to help answer that question.

What Factors Determine The Cost of RV Insurance?

The variables that go into determining RV insurance rates include:

- Your driving record

- Your age

- Your gender

- Your marital status

- Your credit score

- The model, type and age of your RV

- Its storage location

- Usage for vacation or as a primary residence

- The average number of days per year you intend to use the RV, typically grouped as more or less than 150 days

Different Types of RV Insurance

Because RVs come in all shapes and sizes, insurance also needs to come in all shapes and sizes. There are three classes of drivable motorhomes, A, B, and C. Then there are the towable RVs such as fifth wheels, popup campers, and travel trailers.

The main difference in coverage requirements is simple. Any vehicle you drive on the road is required to be insured, and that includes motorhomes. You will be required to have at least minimum liability for your state to legally drive on the road. More coverage is available and optional unless required by a lender. If you tow an RV like travel trailers, pop-ups, fifth wheels, or truck toppers, insurance is probably optional. However, we suggest you have some type of coverage.

If you have a drivable RV, here is the list of the different types of coverage:

- Bodily Injury & Property Damage Liability

- Uninsured Motorist

- Personal Injury Protection (PIP)

- Limited Property Damage

- Property Protection

- Comprehensive

- Collision

If you are pulling a trailer, here is the list of different types of coverage:

- Comprehensive

- Collision

Motorhome/RV Insurance

Since your motorhome has the characteristics of a vehicle and a home, you’ll want to make sure you’re covered from all angles.

- Property Damage Liability: Protects you and other insured drivers if one of you damages another person’s property in a covered accident you’re legally liable for.

- Collision Coverage: When your motorhome is in a covered accident, this helps pay for the damages.

- Comprehensive Coverage: Covers damage to your motorhome caused by falling objects, fire, theft, vandalism, flood, and some other non-collision losses.

- Bodily Injury Liability: Protects you and other insured drivers if one of you injures or kills someone in a covered accident you’re legally liable for.

- Contents Coverage: Covers property in your motorhome when it’s damaged or destroyed due to fire or lightning.

- Personal Injury Protection Coverage (PIP): If you, your family members or your passengers are in a covered accident, this takes care of reasonable and necessary medical, rehab or funeral expenses. It even covers work loss, survivors’ loss and essential services like household maintenance. The coverage varies by state, and you might hear it called “no-fault” insurance.

- Uninsured & Underinsured Motorist Coverage: If a driver who has no insurance injures or kills you, your family members or your passengers, this type of insurance covers you. It also applies if the driver doesn’t have enough insurance to cover the damage they’ve caused you.

- Rental Reimbursement Coverage: If something happens to your motorhome related to the comprehensive or collision coverage you have, this covers the cost of renting a motorhome or automobile in its place.

- Towing and Labor Costs Coverage: If your motorhome breaks down, this includes the cost of labor done on the spot and the cost of towing.

Travel Trailer Insurance

Liability insurance is generally extended from your car insurance policy to your RV when you are towing a trailer. Whether RV insurance is optional or required, you must be aware of the pitfalls of going without RV insurance. Lots of RV owners leave their RVs parked out in the open, leaving them susceptible to storm damage, vandalism, and possible theft. If your travel trailer holds not only a significant monetary value, but you want to keep making those precious memories in your travel trailer, we highly suggest you purchase full coverage RV insurance to protect against a potential loss so you can keep building your memories.

What Other Coverage Should I Consider?

It is important to remember that RVs have specific features that should be included in the policy. Many motorhomes and travel trailers have awnings, and when a big gust of wind comes up and snaps one of the arms on the awning, you want to make sure that is covered.

A few other options that RV owners should consider are:

- Roadside Assistance – This will help when you have a mechanical or electrical breakdown, battery failure, flat tire, accidental lock-out, and insufficient supply of fuel oil, water, or other fluids.

- Pet Injury Coverage – If you are like most of us pet owners, you will want to bring your fur-baby everywhere you go in your RV. This coverage will help if your pet is hurt while you are away from home.

- Vacation Liability – One of the most important types of optional RV coverage is vacation liability insurance, which will pay for bodily injury and property damage if someone or something gets hurt in or around your RV.

- Personal Effects – You can get basic personal property coverage up to a specific limit or schedule individual items like cameras, binoculars, or any expensive personal items. So if you happen to leave your camper and go exploring and get back and come to find out someone helped themselves to your property, this will help cover those expenses.

- Trip Insurance – Since you are typically away from home when an accident occurs in an RV, you can purchase trip insurance to cover transportation and living expenses.

Related Questions

1. Is an Extended Service Plan Considered Insurance?

An extended service plan is not exactly an insurance policy but it acts sort of like one. It will cover you against defaults with the mechanical parts of you RV.

RELATED READING: For a much more in depth article about extended warranties check out our article called Is The Good Sam Extended Service Plan Right For You?

2. Is Roadside Assistance Insurance?

A Roadside Assistance is not insurance but it is great to have a roadside assistance plan in case you break down somewhere.

RELATED READING: For a whole lot more info all about Roadside Assistance check out our article called Protecting Your Travels with RV Warranties: What, How, and Why.

.

Conclusion

The final step in finding good RV insurance is choosing a good insurance company based on your particular needs.

I just want to be clear that we are not insurance experts. Our article is intended to help raise awareness about the types of RV insurance and related issues. We recommend you speak with a licensed insurance agent in your state before making any insurance decisions.

Do you have full coverage or just the minimum? Do you pay a little extra to have your pets covered or additional coverage for that just-in-case scenario? Please share your thoughts with us about your RV insurance costs in the comments below!

If you would like to contact us directly please feel free to visit our Contact Page to send us an email.

To see a list of all of our articles check out the Blog Archive!

It is recommended to have special travel health insurance if you travel to Canada or Mexico. This health insurance isn’t related to accidents or collision. Example: if you are camping in your trailer then have abdominal pain and you go to an emergency room and have appendicitis. It will be covered because you are traveling and it is not related to an accident.

Great suggestion to make sure you are covered if you are out of the country.

Thanks for the heads up!

Mike